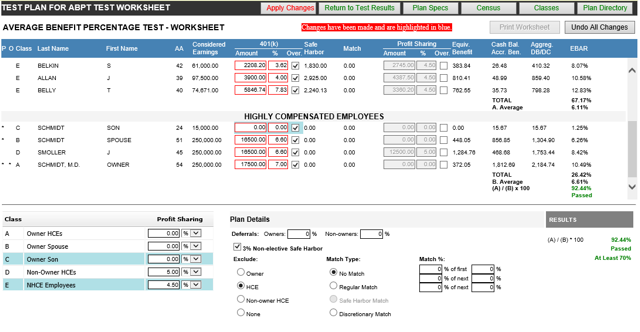

How to pass ABPT for this plan using the new Worksheet:

.png)

|

1.The ABPT is less than 70%. It is 40.57%

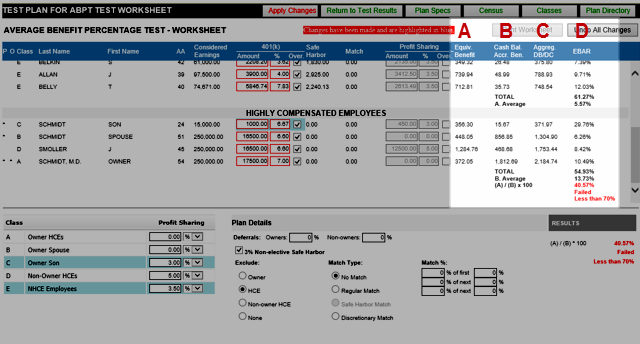

2.The first thing to look for are young HCEs with very low pay and a 401(k) or profit sharing contribution.

They are usually related to the owners but are not paid very much. Oftentimes, it is a spouse wanting to defer her entire compensation yet her compensation is less than or just equal to the deferral limit.

Note that the ABP test is the only test that includes the deferrals for testing purposes. Look at the son of the Owner - 24 years old with a compensation of $15,000 and a $1,000 deferral.

3.Exclude the son from deferrals by entering zero in the amount or the percent. It will automatically recalculate the test once you click outside the data field. But it still fails, and the ABPT now increases to 63%.

4.Let's try increasing Class E from 3.5% to 4.5%. Again, it recalculates to 69%.

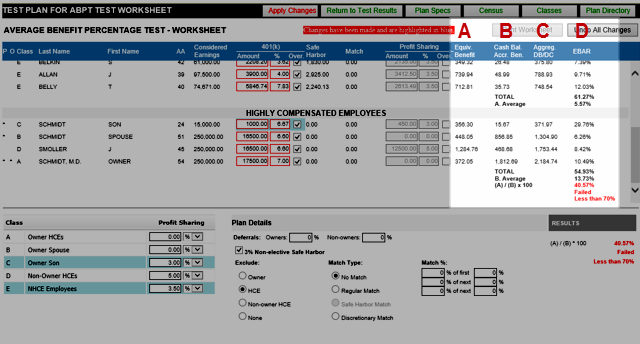

5.Finally, exclude the son from the profit sharing by changing Class C from a profit sharing of 3% to zero.

Now the ABPT passes at 92%. And here it is after it passes. |